At first glance, managing medical billing internally is the most cost-effective approach for healthcare practices, especially FQHCs and Tribal Health. You have control over your staff, systems, and workflow. But when you dig deeper into the numbers—and factor in everything from software costs to denials to staffing turnover—in-house billing can become significantly more expensive than expected.

In this article, we’ll explore the real costs behind internal billing operations and explain why outsourcing to a trusted partner like CPa Medical Billing can improve your bottom line, reduce risk, and give your team more time to focus on patient care.

The Direct Costs of In-House Billing

Medical billing requires a well-trained team, up-to-date systems, and constant oversight—all of which come at a price.

1. Salaries and Benefits

Hiring experienced medical billers and coders isn’t cheap. According to the Medical Group Management Association (MGMA), the median salary for a medical billing specialist is approximately $56,652 per year, not including the costs of benefits, payroll taxes, or paid leave.

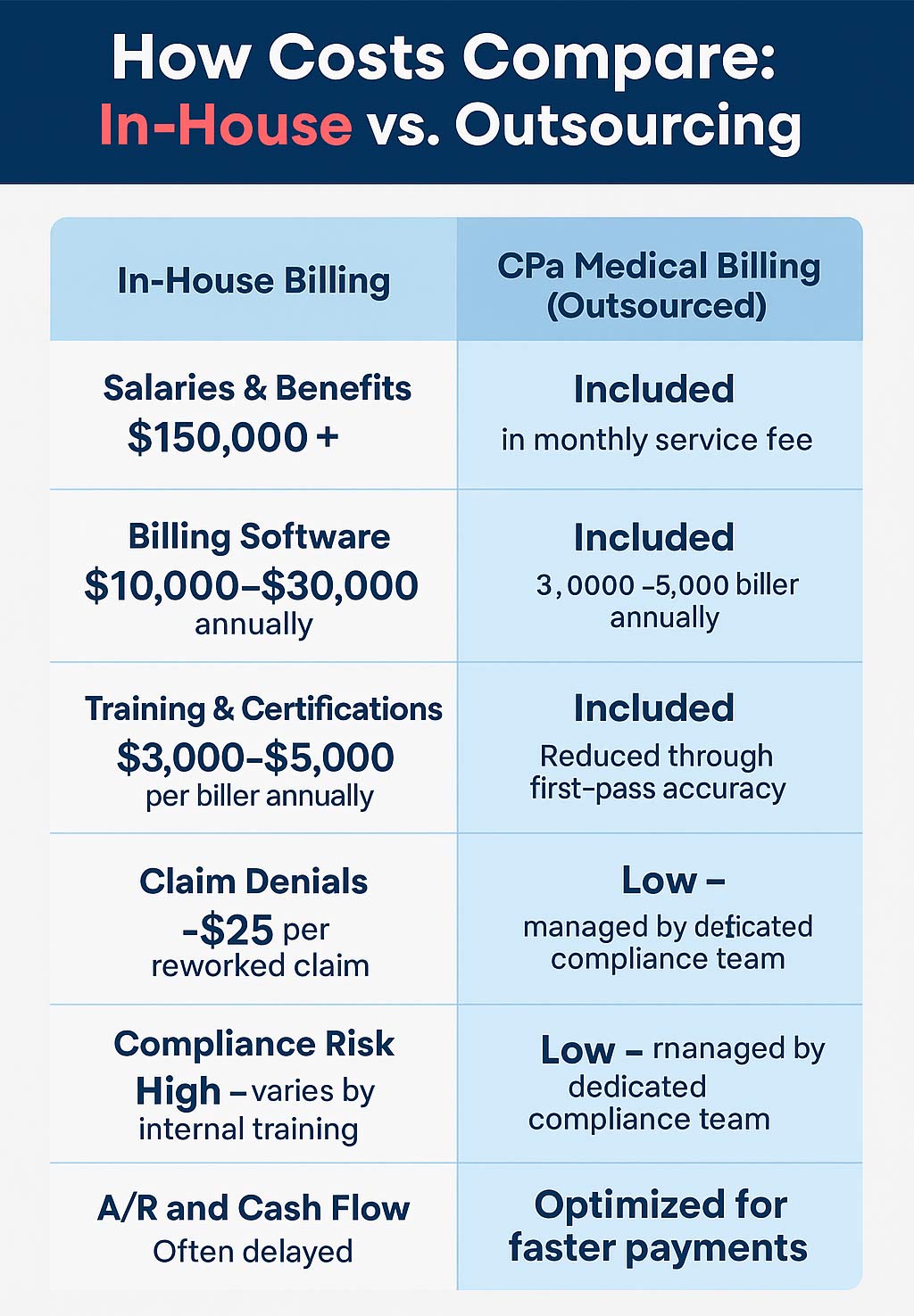

For practices with a small billing department, total compensation costs can easily exceed $150,000–$200,000 annually. These expenses increase if you need a billing manager, a denial specialist, or AR follow-up support.

🧾 Source: MGMA DataDive Provider Compensation 2023

2. Billing Software & Technology

Effective billing requires EHR integration, clearinghouse access, and billing platform licensing. Depending on features, most systems charge $500–$1,500 per provider per month. That adds up quickly, especially for multi-provider or multi-location practices.

Don’t forget the costs associated with:

- Annual license renewals

- Technical support and troubleshooting

- Add-ons like real-time eligibility checks or automated patient billing

🧾 Source: HealthIT.gov | TechTarget: SearchHealthIT

3. Ongoing Training & Certifications

Medical coding guidelines, compliance regulations, and payer rules change constantly. Your billing team will need annual training and certifications, especially for ICD-10, CPT, HCPCS, and payer-specific edits to stay current.

Annual costs per staff member, including CEUs, webinars, and workshops, typically range from $3,000 to $5,000.

🧾 Source: American Academy of Professional Coders (AAPC), 2023 Salary Survey

4. Errors and Lost Revenue

Even well-trained billing teams make mistakes, and each one can cost your practice money. According to the American Medical Association (AMA), up to 20% of medical claims are denied or delayed, often due to missing information, incorrect codes, or eligibility issues.

It costs an average of $25 to rework and resubmit a single denied claim, and better processes can avoid many of these denials.

🧾 Source: AMA National Health Insurer Report Card

The Hidden Costs No One Talks About

Beyond what appears in your budget spreadsheet, deeper issues quietly erode profitability when billing is handled in-house.

Staff Turnover and Training Gaps

Billing roles often have high turnover due to burnout, lack of advancement, or better offers. Each time a biller leaves, your practice pays for recruitment, onboarding, and retraining, and often experiences slowdowns in claims submission or collections during the transition.

🔄 According to Becker’s Healthcare, turnover for revenue cycle roles reached 20–30% in some regions during 2023.

Compliance and Regulatory Risk

HIPAA compliance, payer audits, and government reporting all require strict documentation and secure processes. Internal teams are often stretched too thin to stay ahead of regulations, which increases the risk of violations or penalties.

A single HIPAA breach can result in up to $1.5 million in civil penalties per year, plus reputational damage.

🧾 Source: HIPAA Journal

Delayed Cash Flow

Without dedicated denial management and payer follow-up, your billing team may take longer to resolve claims or appeal denials. This leads to longer days in A/R, inconsistent revenue, and strain on operational budgets, especially in safety-net clinics or smaller practices.

🧾 Source: RevCycleIntelligence

Outsourcing: A Cost-Effective, Scalable Solution

When you outsource medical billing to a specialized domestic partner like CPa Medical Billing, a GeBBS Healthcare company, you eliminate many of the overhead costs and inefficiencies of in-house teams.

Instead of managing payroll, training, software, and denials yourself, you get:

- A fully trained team of billing and coding experts

- Access to modern billing systems and reporting tools

- Denial prevention and appeals are handled proactively

- HIPAA-compliant infrastructure built to scale with your practice

Why Practices Choose CPa Medical Billing

Whether you manage an FQHC, CHC, Tribal Health Center, or private multispecialty group, CPa Medical Billing brings unmatched expertise to complex payer environments.

We specialize in:

- Medicaid, Medicare Advantage, and wraparound payment strategies

- Denial reduction through clean claim submission

- HIPAA-compliant processes and audit support

- Revenue cycle consulting tailored to underserved providers

Outsourcing isn’t just a cost-saving measure—it’s a way to protect your revenue, improve efficiency, and reduce your administrative burden.

Final Thoughts: Outsourcing Pays Off

It’s easy to underestimate the actual cost of in-house billing. Between payroll, software, denials, and regulatory risks, in-house billing often drains time and money, especially for organizations already operating with limited resources. When you compare these costs with the potential savings from outsourcing, the financial benefit becomes clear.

Outsourcing to a trusted, experienced billing company like CPa Medical Billing can offer cost savings and peace of mind. Our team stays ahead of industry changes, payer policies, and compliance updates so you don’t have to.

Ready to see how much you could save? Take the first step towards improving your revenue cycle performance by scheduling a free billing assessment with CPa Medical Billing today. Schedule a free, no-obligation billing assessment with CPa Medical Billing today. This comprehensive review will clearly explain your current billing costs and potential savings without hidden fees or obligations.

Sources:

- MGMA DataDive Provider Compensation 2023 – https://www.mgma.com/data

- AMA National Health Insurer Report Card – https://www.ama-assn.org

- RevCycleIntelligence – https://revcycleintelligence.com

- HIPAA Journal – https://www.hipaajournal.com

- Becker’s Healthcare – https://www.beckershospitalreview.com

- AAPC 2023 Medical Coding Salary Survey – https://www.aapc.com

- HealthIT.gov – https://www.healthit.gov

- TechTarget SearchHealthIT – https://www.techtarget.com/searchhealthit