Take your financial health to new heights with the help of an outsourced billing partner.

Whether you lead a health center, hospital, or private practice, your in-house employees are critical to your overall success. However, there can be times when it’s difficult for time-strapped staff to keep up with heavy workloads and navigate the ever-shifting tides of the healthcare industry. Moreover, an ongoing labor shortage with no end in sight compounds the difficulty of sustaining a complete and experienced team. As a result, many organizations are outsourcing all or part of their medical billing to third-party companies. These highly specialized companies are experts who have the experience and manpower to immediately improve revenue cycles while also maximizing the financial health of your practice.

Given the complexities associated with medical billing, knowing if outsourcing is the right move for you can be difficult. That’s why we’ve developed this comprehensive guide, designed to help decision-makers understand if outsourced medical billing is right for them and if so, what benefits to expect, how to identify the right partner, and so much more.

What Is Outsourced Medical Billing?

Outsourcing your medical billing is when a health center, hospital, private practice, clinic, etc., allows a dedicated third-party partner to handle all or a portion of the back-end billing. This includes everything needed to process a claim after the provider adds their visit notes to the electronic medical record and closes the encounter: charge/coding review, claim submission, payment posting, fix and reprocess claim rejections, process appeals, accounts receivable management and patient payments and statement call center. A dedicated outsourced revenue cycle team focuses on obtaining reimbursement for medical services as quickly and efficiently as possible while optimizing revenue and streamlining your workflows and operations.

The ultimate goal: Maximizing your practice’s overall revenue cycle performance.

Outsourced medical billing companies are HIPAA compliant as the staff handles highly sensitive personal health information. The ideal partner can tailor their experience and expertise to your practice’s unique needs for its specialty/specialties and software systems.

Trends in Outsourced Medical Billing

- Global medical billing outsourcing market value was worth USD 11,748 million in 2021, with an 11.3% of CAGR from 2022 to 2030

- North American region accounted for 46.8% of the medical billing outsourcing market share in 2021

- Asia-Pacific medical billing outsourcing market growth is expected to expand at a CAGR of 12% from 2022 to 2030

- By service, the front-end category captured over 39.1% of total market volume in 2021

Source: Acumen Research and Consulting

Is Outsourced Medical Billing Right for You?

Outsourcing medical billing is a no-brainer decision for some health centers, clinics, and practices. They’re short-staffed, financially drained, and/or lack the internal bandwidth and expertise to manage the complete revenue cycle workload. However, other practices are hesitant to involve an outside company in their finances.

If you’re still on the fence, here are a few questions to consider in determining if this is the right approach for you and your team:

Is my team stressed out with the billing workload?

If the answer is “YES,” you’re not alone. Whether you work for a large health center or a small-sized medical practice, staff members are typically overwhelmed with other administrative responsibilities and, most importantly, taking care of patients. The ever-changing landscape of the healthcare industry makes it difficult for any in-office team to stay on top of best practices for medical billing and delivering superior patient care and service

On the flip side, medical billing companies are solely focused on medical billing. With this option, there’s a clear separation from a medical office’s internal day-to-day operations. Third-party medical billers have no other choice but to make medical billing their only priority.

Is your dedicated medical biller leaving?

If you’re dedicated medical biller or manager is leaving your organization, this is the prime time to consider outsourcing all or part of your medical billing. The risk of hiring an inexperienced or inefficient medical biller can cost your practice A LOT of money due to delayed payments and write-offs. You have to find an expert biller with a strong understanding of revenue cycle management, specifically within your specialty and coupled with a good understanding of how to work within your software system(s). However, recruiting, interviewing, and training top-notch candidates takes considerable time and resources that you may not have, plus an ongoing labor shortage has significantly reduced the number of qualified candidates available for hire.

Outsourcing medical billing instantly relieves the anxiety surrounding your former biller’s departure. Not only can the outsourced provider take over the workload, but they can improve upon existing policies and procedures to maximize revenue.

Are we achieving our revenue goals?

Based on your facility’s size, location and specialty, are you hitting your projected revenue targets? How does your overall profitability compare to other medical practices in your market? Are there any gaps in your revenue performance? Hiring a medical billing company often increases your speed to collections while also increasing the amount of net collections.

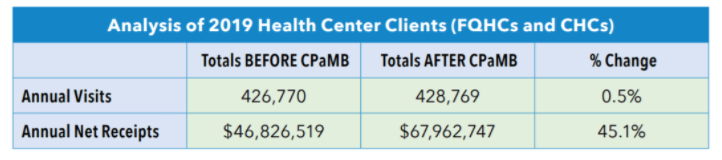

This chart illustrates how a medical billing company increased net receipts by 45% on average for their health center clients.

Evaluating marketplace data can help you answer important revenue questions and support the outsourcing decision. Some helpful sources include:

- Medical Group Management Association Benchmarking Data

- Healthcare Financial Management Association

- National Association of Community Health Centers Research & Trends

- American Medical Association Steps Forward™

Should we use general billers or medical billing specialists?

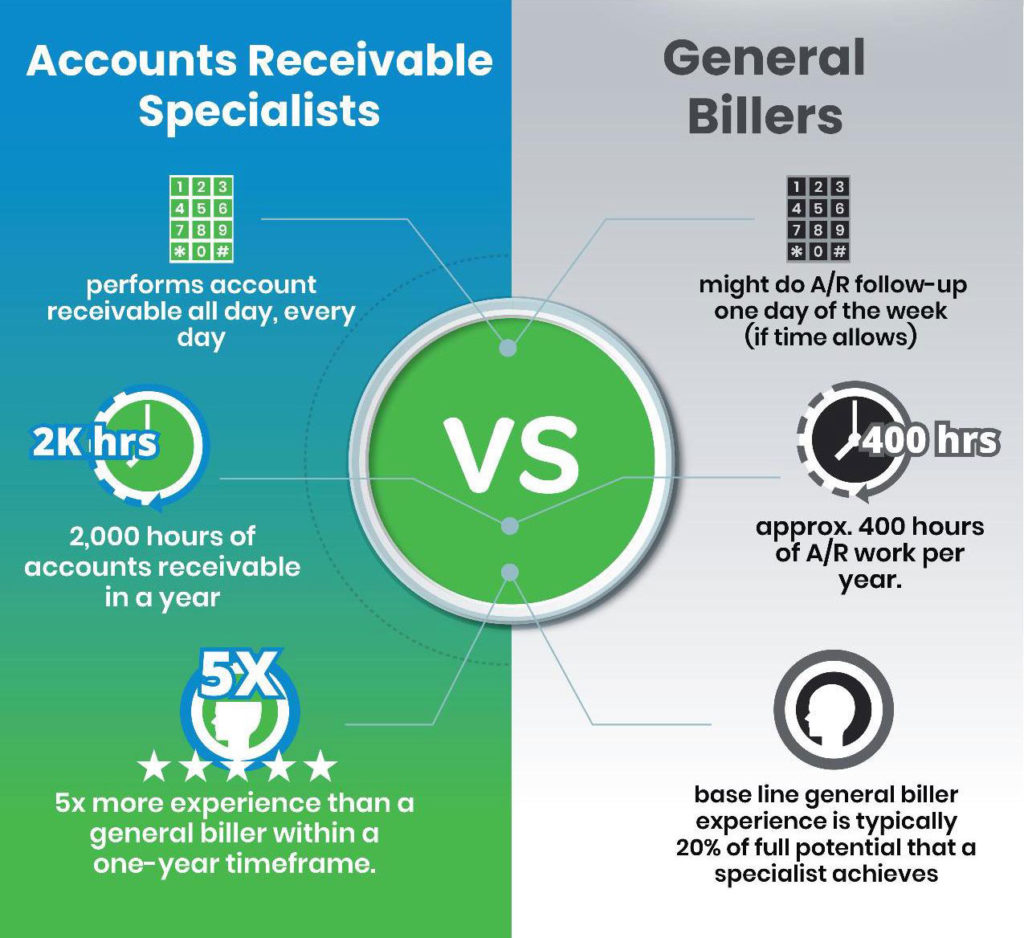

There are key distinctions between a medical billing specialist and a general biller. As demonstrated by the graphic below, a dedicated specialist delivers significantly better results when it comes to workload capacity and performance. If you’re using general billers, you should consider rethinking the approach to using specialists, which always deliver better results.

For example, a general biller might perform A/R work one day of the week while juggling other tasks the remainder of the week. One day of dedicated A/R work equates to approximately 400 hours per year. In a specialist setting, an A/R medical billing specialist performs accounts receivable work every day. In one year, this adds up to 2,000 hours, equating to 5x more experience than a general biller within one year.

General billers are often good enough to get money in the door but far from achieving optimal financial results. They typically fail to manage critical best practices, leading to long A/R delays, coding deficiencies, lower reimbursements, and reduced cash flow.

Are you switching software systems?

Switching systems is a perfect time to align your medical practice with a medical billing company that is expert in the software systems you’re switching to. This will ensure a turn-key implementation and eliminate revenue cycle lags typically experienced by keeping an internal team that may have difficulty learning a new software system.

Is your medical billing team performing tasks that fall outside of medical billing?

In order to achieve optimal medical billing results, a billing team must be 100% dedicated to only medical billing. If your facility is pulling the medical billing staff to solve other important issues such as staffing the front desk, performing medical assistance, answering phones, etc., this is a red flag to strongly consider outsourcing medical billing.

Do we need a long-or short-term medical billing solution?

It depends on your unique situation and goals. The majority of outsourced billing companies can handle short-term month-to-month engagements while you try to fill a staffing gap or to work on a pre-defined scope of work/special project that requires supplemental staffing to get caught up.

On the flip side, many health centers and medical practices establish engagements with medical billing companies for a specific period of time that outsources the entire revenue cycle end-to-end making the medical billing company completely accountable for all medical billing results.to. Not only are there increases in productivity, billing accuracy and revenue optimization, but they also enjoy major savings by reducing costs (i.e. administrative salaries and benefits, management, training, equipment, IT/software, office space, etc.).

How will this affect my patients?

Are we using front-end staff to work billing and does this take away from the patient experience?

Patients should be the top priority, along with your employees, when weighing the pros and cons of outsourced medical billing. Fortunately, many health centers and practices report increased patient satisfaction because their staff can dedicate 100% of their time and energy to delivering quality care and service to their patients.

Your outsourced medical billing company should also include a patient statement call center, which takes the burden off of your front desk staff, allowing them to focus their efforts on patients. For instance, CPa Medical Billing services include a bilingual call center to handle all patient statement questions and collect payments. Our clients value the call center because it frees up their front desk to handle other patient inquiries and essential tasks such as insurance verification, scheduling, pre-authorizations, etc.

Temp Agency Staffing vs. Medical Billing Company

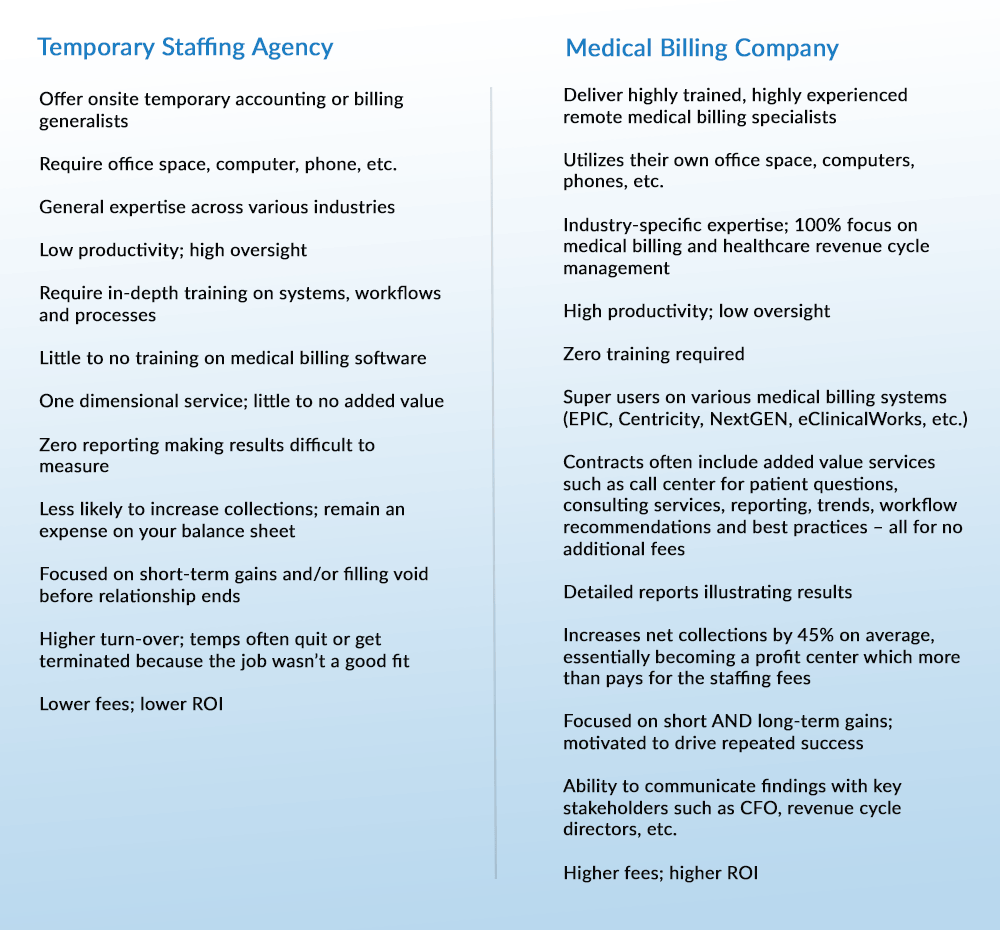

You might be wondering whether you should hire temporary staff from a staffing agency or go through a specialized medical billing company. Although there’s nothing wrong with choosing the temp agency route, there’s an age-old saying to keep in mind: “You get what you pay for…”

While temps can certainly fill a void in certain areas, they’re often inexperienced when it comes to medical billing. Inexperience translates into low productivity with high oversight and training on your end. A smart option is to contract with a medical billing company that provides an experienced remote turn-key medical billing specialist – or team of specialists – which yields tremendous results with absolutely no supervision or training. Yes, the hourly rate for a medical billing specialist could be 2-3x the cost of a temp agency staffing person. However, the results are 5-10x better when compared to a temp agency.

Utilizing a medical billing company provides a far greater ROI to your practice. Use the chart below to help you understand the major differences between these two options.

Key Differences

Top 10 Benefits of Outsourced Medical Billing

As mentioned earlier in this article, outsourced medical billing has grown in popularity in recent years. It’s not just a temporary trend – it’s a smart business strategy that’s here to stay. Countless healthcare centers and practices, regardless of size, location or revenue, recognize the value of transitioning their medical billing to a highly specialized company that handles the entire revenue cycle process. Ultimately, this gives a medical facility an opportunity to concentrate on its core purpose: providing excellent patient care and customer service.

For more reasons to outsource your medical billing, here are the top 10 benefits to consider:

1. Maintain business continuity

Staff shortages have plagued the entire healthcare industry for the last few years. When you’re down just one or two team members, it places a burden on everyone else while they attempt to fill the staffing gaps. More often than not, they are set up for failure by not having enough hours in the day, which increases stress levels and leads to burnout. Staffing constraints translate into a poor revenue cycle – too many claims aren’t properly worked, leading to a ballooning A/R, increased denials, and decreased cash flow. These issues can spread like wildfire across the organization, influencing employee morale, staffing turnover, and, in the worst cases, the patient experience.

By outsourcing your medical billing, you’re taking a huge weight off of your team’s shoulders, allowing them to focus on their primary roles while your medical billing partner maximizes your financial health.

2. Strengthen cash flow

A superior outsourced medical billing partner leverages certified professional coders that scrub claims before sending them off to payers. Claims are submitted every day and correctly on their first submission, leading to much faster claims processing, fewer rejections, higher reimbursements, and, subsequently, a reduction in your outstanding A/R days.

The goal should be to have your outstanding days in A/R less than 30 days. Reducing your outstanding A/R days will always provide a more reliable and predictable cash flow while increasing your cash days. Moreover, using a medical billing company reduces your upfront expenses as their fees are collected AFTER your facility receives reimbursement.

3. Gain specialized expertise

Your team is talented and capable, but they can only do so much with limited knowledge, training, and time. Not to mention, they have so many other tasks on their plates, making it hard to give medical billing the time and attention it needs and deserves.

Although in-house billing teams are usually good enough, you have to wonder why to settle for good enough when you can partner with experts who can return more revenue. Think about it: if you had a serious medical issue, would you settle for a general practitioner or seek a specialist with expertise in your area of concern?

An outsourced billing partner devotes resources to medical billing. They are 100% accountable for the revenue cycle results and for getting the job done right day in and day out. Additionally, the outsourced team is responsible for monitoring regulatory changes, scrutinizing payor habits and idiosyncrasies, and staying current on best practices.

Billing companies also have the advantage of a much broader perspective. With multiple client accounts on their rosters, billing companies can leverage key learnings and best practices to maximize returns for all clients.

4. Reduce billing errors

Even a small medical billing mistake can be a BIG deal. All mistakes impact reimbursement and result in claim denials that snowball into a mess that is hard to dig out of. When billing is done in-house, these denied claims often go untouched, even if there’s reimbursement waiting to be claimed, because staff members have already moved on to other tasks.

A highly experienced medical billing partner ensures your claims undergo a thorough and efficient submission process using best practice workflows. Mistakes are quickly caught and communicated to your front desk and providers. Denials and appeals are worked on daily. All of this translates into the highest-paid reimbursements at the fastest collection time possible and, ultimately, more money for your practice.

5. Elevate the patient experience

When you have dedicated medical billing specialists on your team, patients have direct communication with experts who can respond to their billing questions and concerns as quickly and effectively as possible. Plus, your front desk staff will now have a lot more time to dedicate to better patient interactions and completing their core responsibilities (insurance pre-authorizations, scheduling, etc.), which undoubtedly will result in an improved patient experience.

6. Reduce overhead costs

Partnering with a medical billing company reduces overhead by changing your cost structure from a fixed departmental expense to a variable cost that’s directly tied to the net revenue collected.

Having medical billing department expenses directly associated with net collections makes financial sense because the billing fees are variable and tied to actual results of how quickly and how much gets collected on a monthly basis. Your medical billing fees are down when patient visits and reimbursements are down. When visits and reimbursements are up, fees are higher but so are the results.

7. Expand clinical space

By outsourcing your medical billing, your unused administrative space can be turned into revenue-generating space, such as additional exam rooms or an on-site lab. Converting admin space to revenue-generating space can potentially generate hundreds of thousands in additional revenue for your practice.

8. Shift medical billing from an expense to a profit center

In-house medical billing is a hefty, fixed expense requiring salaries, benefits, training, management, IT costs (equipment and support), office space and more. Often, there’s little to no ROI on these costs.

Outsourcing your medical billing transforms the situation entirely, allowing you to make more money with a lot less hassle. Not only will you eliminate the overhead and taxing administrative duties, but you’ll also increase cash flow because billing fees are due 15 days AFTER you collect your receipts. Additionally, partnering with a medical billing company inserts a team of expert medical billers that have always increased net collections, so much so that these increases more than pay for the billing fees.

9. Increase your revenue – divide and conquer!

There’s no denying that in-house medical billing can get put on the back burner while the staff is tasked with putting out immediate fires typically linked to assisting patients. Busy schedules, short staffing and patient care demands are understandably a higher priority than claim submissions and reimbursement collections.

A strong medical billing partner has the ability to increase your revenue in a couple of ways. First off, they optimize your coding and billing workflows. Timely, clean claim submissions pave the way for maximum reimbursements in the shortest period of time. Denied claims aren’t ignored; they are corrected and resubmitted daily. Claims requiring appeals are also worked daily. All of this leads to greater cash flow and increased revenue.

Next, you can divide and conquer. While your in-house team is 100% dedicated to providing superior patient care and customer service, your medical billing company is 100% dedicated to achieving maximum performance within your revenue cycle. It’s the best of both worlds. Typically, outsourced medical billing companies claim that they are 5-15% better at collecting receipts than in-house billing teams. At CPa Medical Billing, our health center clients have averaged an increase of 45% in their net receipts.

10. Scale your business

Amid uncertain and rapidly changing times, your organization’s financial health is more important than ever. With lower overhead costs and increased revenues generated from outsourcing your medical billing, you have the exciting opportunity to grow your practice like never before.

Do you want to offer a new specialty, hire more providers, create a new clinical space or internal lab department, enhance community outreach, or offer additional locations? These steps are crucial if you want to elevate patient volumes and build a strong brand reputation throughout the community. The sky is the limit when you have the time, flexibility, and, of course, money to grow.

Outsourcing Costs

Outsourced medical billing may “sound” expensive, but the rewards heavily outweigh the costs. Let’s explore the costs and real ROI of outsourcing your medical billing. When peeling back the layers, there’s no comparison that using an outsourced medical billing company yields better results.

Is Outsourcing Expensive?

In looking at the big picture, outsourced medical billing is not expensive, especially compared to hiring and maintaining an in-house team.

Many practices and clinics forget that in-house medical billing isn’t just about reimbursement for healthcare services provided. There are various operational costs that can crush your bottom line, including:

- Recruiting and training medical billers and certified professional coders

- Paying hourly wages or salaries in addition to benefits, paid time off and office space overhead

- IT fees (supply/support computers, software licenses, printers, phones, etc.)

- Supplies (paper, toner, office supplies, and postage)

- Decrease in collections and cash flow (inexperienced or overworked staff may write off denied claims instead of engaging in proper follow-up or resubmitting the claim)

- Increase in bad debt due to unpaid claims

Outsourced medical billing lowers the cost and burden of operations while also mitigating billing mistakes, improving compliance and more. It also allows your staff to connect with patients without the stress of having to discuss a bill.

What Are the Fee Structures or Pricing Models for Outsourced Medical Billing?

Medical billing companies typically charge a percentage of NET collections and get paid AFTER you get paid. There aren’t any discrepancies on results as the software system produces a report for monthly reimbursements received and the billing company applies their fee % to this total and invoices monthly.

Fees range depending on volume, specialty and software systems. Regardless of the fee, partnering with the right medical billing company will always provide better results than an internal billing department.

What’s the ROI on Outsourced Medical Billing?

Outsourcing your billing services may seem like an expense but, in reality, it’s an investment in the financial health of your medical facility.

Generally, the ROI will vary depending on the size of your practice. That said, CPa Medical Billing health center clients average an increase of 45% in their net receipts. One Federally Qualified Health Center client in Boston, MA experienced the following performance increases:

- 72% improvement in A/R days

- 110% improvement in cash receipts

- 520% improvement in days with cash on hand

Partner Qualifications & Expectations

Once you’ve made the choice to outsource your medical billing, there’s another important decision that needs to be made: Which company will you work with?

There are a lot of third-party medical billing companies who would love your business, but not every company is the right fit. When interviewing prospects, ask questions that help you assess their qualifications and ability to get the job done.

10 Questions to Ask When Interviewing a Medical Billing Company

Use these questions to help you find the perfect medical billing partner:

1. How much experience does your company and team have?

Medical billing isn’t rocket science but it is a complex and tedious process that requires specialized experience and expertise. Particularly with the adoption of ICD-10 codes and other regulatory changes, you need to work with a company that hires billers who understand your specific specialty as well as your specific software system(s) while also keeping current with the ever-changing rules and regulations. For example, a radiation oncology practice has very different needs and challenges than a FQHC – Federally Qualified Health Center. The medical billing company you partner with must demonstrate a proven track record to navigate the issues and optimized workflows related to your specialty and software

You should always ask for case studies, testimonials and references. If they can’t provide information or contacts that align with your needs, show them the door.

2. What is your fee structure/pricing?

This is a big question. Ideally, the rate should be a percentage of net collections. A percentage is a better option than a flat rate because it aligns the interest of both the practice and the medical billing company. The more the billing company collects for the practice, the more they collect for themselves and the faster they billing company collects for the practice the faster they collect for themselves.

Be careful not to evaluate on the percentage fee alone. Would you rather pay 6% for $10M of collections or 4% for $7M of collections? The answer is easy, you would gladly pay a higher percentage for better results. The moral of the story is to focus on the results, not the percentage.

Also, don’t forget to inquire about any onboarding fees, termination fees, contract duration, data conversion fees, etc. A professional firm would be upfront with everything in their proposal.

3. Does the contract agreement offer additional services? And, are these included in the base fee or added on as an additional cost?

A strong medical billing partner always brings additional value to the relationship. For example, CPa Medical Billing offers the following services:

- Training internal staff on how to use medical billing software systems and educating on best practices/workflows

- Managed care contract negotiation

- Developing ancillary revenue streams (labs, patient evaluations, etc.)

- Practice/growth expansion consulting

- Quarterly and year-end financial reporting, working in tandem with your CFO and accounting firm/team.

4. Will I have a dedicated account executive?

Many medical billing companies are working with multiple clients at any given time. Be sure to ask your candidates who your dedicated account executive will be and how often you’ll meet to review performance metrics, troubleshoot issues, etc. It’s important that you work with someone who responds quickly and makes you feel confident about your medical billing processes. Consider requesting a resume or job descriptions to learn what caliber of personnel you will receive.

5. What reporting will I receive? And how often?

Ask about the types of reports you’ll receive as well as how frequently you will receive them. Reporting is an excellent way to measure your progress and identify areas of improvement.

An experienced partner should deliver customized reports that detail A/R days, patient visits, productivity by provider, collections, analysis of charges, receipts, gross and net collections payment adjustments, cash flow, etc., plus any other requirements you’d like to add to the list. Ideally, you receive a monthly report plus quarterly and yearly reports that provide insight into ROI.

6. Do you have a general liability insurance policy and a compliance plan in place?

Given the ever-changing healthcare landscape, it’s critical for your medical billing partner to be up to date on government regulations. You’ll also want to ensure your partner is HIPAA compliant and has security protocols in place to protect patient privacy. Having a business associate agreement (BAA) and the proper liability coverage in place is also important.

7. Who handles patients’ billing questions and concerns?

Without a doubt, patients will call your practice with questions about deductibles, co-insurance, co-pays and more after receiving their billing statements. You need to determine if your medical billing partner is going to handle all of the inbound calls related to billing and how they plan to resolve any issues or objections in a satisfactory manner.

Keep in mind, some patients who speak in other languages may require a translation service. Does your medical billing partner offer this or is it something that you’ll have to solve for? Don’t forget to ask this question during the interview process.

8. Where is your staff located?

Some medical billing companies outsource aspects of their own operations to offshore companies as a way to reduce their overhead costs. This practice is not uncommon, however it’s important to understand how it impacts your practice – and your patient experience.

As we’ve mentioned a few times, medical billing requires highly trained specialists operating in a HIPPA environment with proper IT security measures in place. If patients are reaching out to the call center, it’s important that all representatives are able to answer questions quickly and effectively. Otherwise, patient satisfaction and retention rates will plummet.

Don’t hesitate to ask for IRS form 941, which illustrates exactly how many US-based employees a company has on their payroll. Many billing companies will have a US office and tell you their company is US based, but when you look into the 941, it shows a handful of employees are located offshore.

How is their IT managed? Do they have the proper security protocols in place and the proper insurance to cover an unlikely security breach that can occur?

9. Are your medical billing specialists comfortable with my software?

Your billing partner’s team should be experts with your practice management software. Ideally, they are fully trained and already use the same system daily when servicing other clients.

A top-tier medical billing company like CPa Medical Billing works within the major practice management systems including EPIC, Centricity, NextGen, eClinicalWorks, Dentrix, etc.

10. How often is a reconciliation performed?

Best practice is to reconcile all deposits on a daily basis so that any discrepancies are tracked down quickly.

FQHC/CHC Medical Billing: Important Considerations

If you are a Federally Qualified Health Center (FQHC) or a Community Health Center (CHC), it’s critical to partner with a medical billing company that specializes in your specific niche. They should understand the nuances and intricacies associated with FQHC/CHC coding and billing, including:

- Medicaid

- Medicare

- Commercial Insurance

- School based programs

- Free care programs

- Telehealth

- etc.

They should also offer billing solutions for a whole array of specialties that are commonly found within CHC and FQHC settings, including internal medicine, behavioral health, dental, ophthalmology, pediatrics, family practice, OB/GYN, and more.

CPa Medical Billing has many years of experience with improving revenue cycles at both FQHCs and CHCs. Our proven track record of maximizing revenue and decreasing payment cycle times for every single client is a testament to how we’re one of the most reputable FQHC/CHC medical billing companies in the entire country.

Best Practices for a Successful Collaboration

Once you’ve selected a medical billing partner, it’s time to set the stage for a strong relationship. Based on CPa Medical Billing’s extensive experience in working with health centers, private practices and healthcare facilities across the U.S., here are some tips for a successful collaboration:

- Share goals—Not every practice has the same strategic objectives, which means your medical billing company needs to provide services and reporting that are catered to your unique needs. Share your expectations early on—before signing the contract—to allow your billing partner to hit the ground running on those key performance metrics.

- Understand expectations –Ask your partner for a complete revenue cycle task list. It should identify who is responsible for every task within revenue cycle management. The majority of tasks will be exclusively handled by the medical billing company, while others are assigned to the practice

- Assign team members – Just like you expect your billing partner to assign a dedicated account manager, you should designate an internal team member to serve as the point person. He/she can attend meetings and respond to billing specialists’ questions, inquiries, or concerns in a timely fashion.

- Commit to sufficient onboarding – Onboarding is the most important phase of a new engagement, as internal staff members may feel uncomfortable with changes impacting their jobs. Any miscommunication can lead to a loss or delay in revenue. That’s why working with a company with a tried and tested implementation plan is essential to reduce stress and minimize disruption. Understand who is doing what and when. Ask for a project plan that details the implementation

- Communicate with transparency – Communication is vital to any relationship, especially when you’re outsourcing medical billing. Your company shouldn’t have any trouble revealing certain data points, especially unflattering ones, and both parties must respond to each other’s questions, concerns, requests, etc., in a timely manner. Strong communication ensures compliance and builds trust. and onboarding process. or shared between both parties.

Debunking Common Myths about Outsourced Medical Billing

It’s clear that outsourcing your medical billing offers distinct advantages, as evidenced by credible research, case studies, and reporting. However, despite the overwhelming benefits and industry growth, some people are still wary of the idea due to common misconceptions about the industry.

Once and for all, we’ll correct the top four misconceptions about outsourcing your medical billing:

Myth 1: I’ll lose control of my revenue cycle process.

Reality: The right partner gives you as much control as you request and better visibility into revenue cycle management.

A best-in-class medical billing company makes your job easier, not more frustrating or confusing. At CPa Medical Billing, our specialists keep their clients in the loop on everything happening with their billing and revenue cycle each month, or more frequently if needed. Our helpful reporting lets you see the big picture regarding your revenue performance and trends, but we’re also happy to share the nitty gritty details and numbers if you enjoy getting into the weeds.

Ultimately, outsourcing can make you feel even more in control than you did previously because you know this important function is in the hands of highly specialized experts. There are fewer billing errors and issues that need to be resolved, making your job – and life – much easier. You can easily report top-level key performance indicators with results that will impress almost every stakeholder (CFO, CEO, board of directors, etc.)

Myth 2: Outsourced medical billing is too expensive.

Reality: Outsourcing your medical billing is less expensive, improves reimbursements, and significantly increases net collections, leading to a stronger financial position.

No matter which path you choose, you have to pay someone to do your medical billing. The question becomes, “Who will I pay, and what results will I achieve?”

Since employees of medical billing companies are highly experienced and trained, they bill more quickly and effectively than in-house staff or temps. They often employ certified professional coders and a team of specialized billers with expert skills to excel at their specific roles within the revenue cycle process. Best of all, they can do the work without any training or oversight on your end.

Typically, medical billing companies only charge a small percentage of your billed charges. In fact, if you hire the right partner, you should save money by outsourcing. Instead of viewing it as an expense, they see it as an investment in the financial health of their organization.

Myth 3: It’s only for larger practices and hospitals.

Reality: Outsourced medical billing is available for hospitals, health centers, clinics, and private practices of all sizes, stages, and specialties.

The most important thing is to partner with a company that can support your unique specialty/specialties and understands the nuances of your billing process, workflows and software system(s).

How AI is Affecting Medical Billing and Outsourcing

Artificial Intelligence (AI) is revolutionizing various industries, and medical billing is no exception. The integration of AI in medical billing and outsourcing processes is enhancing efficiency, accuracy, and overall performance in numerous ways. Here’s how AI is making a significant impact:

Automation of Repetitive Tasks

AI-powered systems can automate many repetitive and time-consuming medical billing tasks, such as data entry, coding, and claim submissions. This reduces the workload on human staff, allowing them to focus on more complex issues and improving overall productivity.

Enhanced Accuracy and Reduced Errors

AI algorithms can analyze large volumes of data with high precision, significantly reducing the chances of errors in medical billing. This leads to fewer claim denials and rejections, ensuring that healthcare providers receive payments faster and with less hassle.

Predictive Analytics

AI tools can analyze historical data to predict trends and identify potential issues in the revenue cycle. This predictive capability allows healthcare providers to proactively address problems before they become significant, optimizing the billing process and improving cash flow.

Improved Compliance

AI systems can help ensure compliance with the ever-changing healthcare regulations and standards. By continuously monitoring and updating compliance protocols, AI can help prevent costly fines and legal issues related to non-compliance.

Fraud Detection

AI can detect patterns and anomalies in billing data that may indicate fraudulent activities. This enhances the security of the billing process and protects healthcare organizations from financial losses due to fraud.

Enhanced Patient Experience

AI can streamline the billing process, making it more transparent and easier for patients to understand their bills. Automated systems can also efficiently handle patient inquiries, quickly and accurately responding to billing-related questions.

Cost Reduction

By automating tasks and improving accuracy, AI can significantly reduce operational costs associated with medical billing. This makes outsourcing more cost-effective, allowing healthcare providers to allocate resources more efficiently.

Continuous Learning and Improvement

AI systems continuously learn from new data, improving their performance over time. This adaptability ensures that AI-powered billing systems remain efficient and effective in the face of evolving industry standards and practices.

In conclusion, integrating AI in medical billing and outsourcing is transforming how healthcare providers manage their revenue cycles. By automating tasks, reducing errors, enhancing compliance, and improving patient experiences, AI is helping healthcare organizations optimize their financial health and focus more on delivering quality patient care.

More Credible Resources

If you’re looking for additional data and resources that help you understand outsourced medical billing, here are a few websites to visit:

- Medical Group Management Association – https://www.mgma.com/

- National Association of Community Health Centers – https://www.nachc.org/

- Healthcare Financial Management Association – https://www.hfma.org/

- American Medical Association – https://www.ama-assn.org/

- Healthcare Finance News – https://www.healthcarefinancenews.com/

- Healthcare Dive – https://www.healthcaredive.com/topic/finance/

Conclusion

Outsourcing your medical billing isn’t always a straightforward decision. As with any major consideration, it’s important to investigate the right solutions and vet potential partners. Whether you’re seeking a short- or long-term engagement, finding a highly specialized and experienced partner can make a world of difference for you, your practice, your patients– and your bottom line.

Since 2003, CPa Medical Billing (CPaMB) has elevated the financial health of private practices, health centers, and medical groups across the U.S. Our highly trained, highly experienced medical billing specialists are all US-based and operate together from in one office. Our engagements are flexible and tailored to your specific needs. If you have questions or would like to contact our team, please call 203-678-9616 or visit https://cpamedicalbilling.com/contact-us/